-

EN

Intelligent adaptive volatility strategy seeks to obtain relatively high returns with a relatively small position and a relatively short holding time. Whenever the market fluctuates, the trigger strategy will open positions on dips in the trading range to quickly and safely reduce costs. When the market rebounds, take profits at the preset take-profit position. It is expected to be 3~5% monthly, with a maximum retracement of 10%~15%.

Based on a complete automated back-testing system, using historical real transaction data from multiple mainstream exchanges, it repeatedly tests daily market conditions and extreme conditions, and outputs more than one million test results in a single time. After a long-term firm offer + backtesting data, the trading model and underlying algorithm of the intelligent adaptive volatility strategy are continuously optimized, and the logic of opening positions, the timing of adding positions, the actual running positions, the position magnification ratio, the dynamic interval range, the number of orders, Dozens of parameter configurations such as the take-profit position are intelligently selected and combined to find the relatively optimal trading plan to avoid the high risk that the traditional grid strategy needs to bear in the unilateral situation. In addition, after each violent market situation occurs, the automatic backtesting system will immediately incorporate the new market situation into the simulated calculation range for backtesting, and timely modify the parameter configuration of the trading target in operation to continue to promote the self-optimization of the trading algorithm.

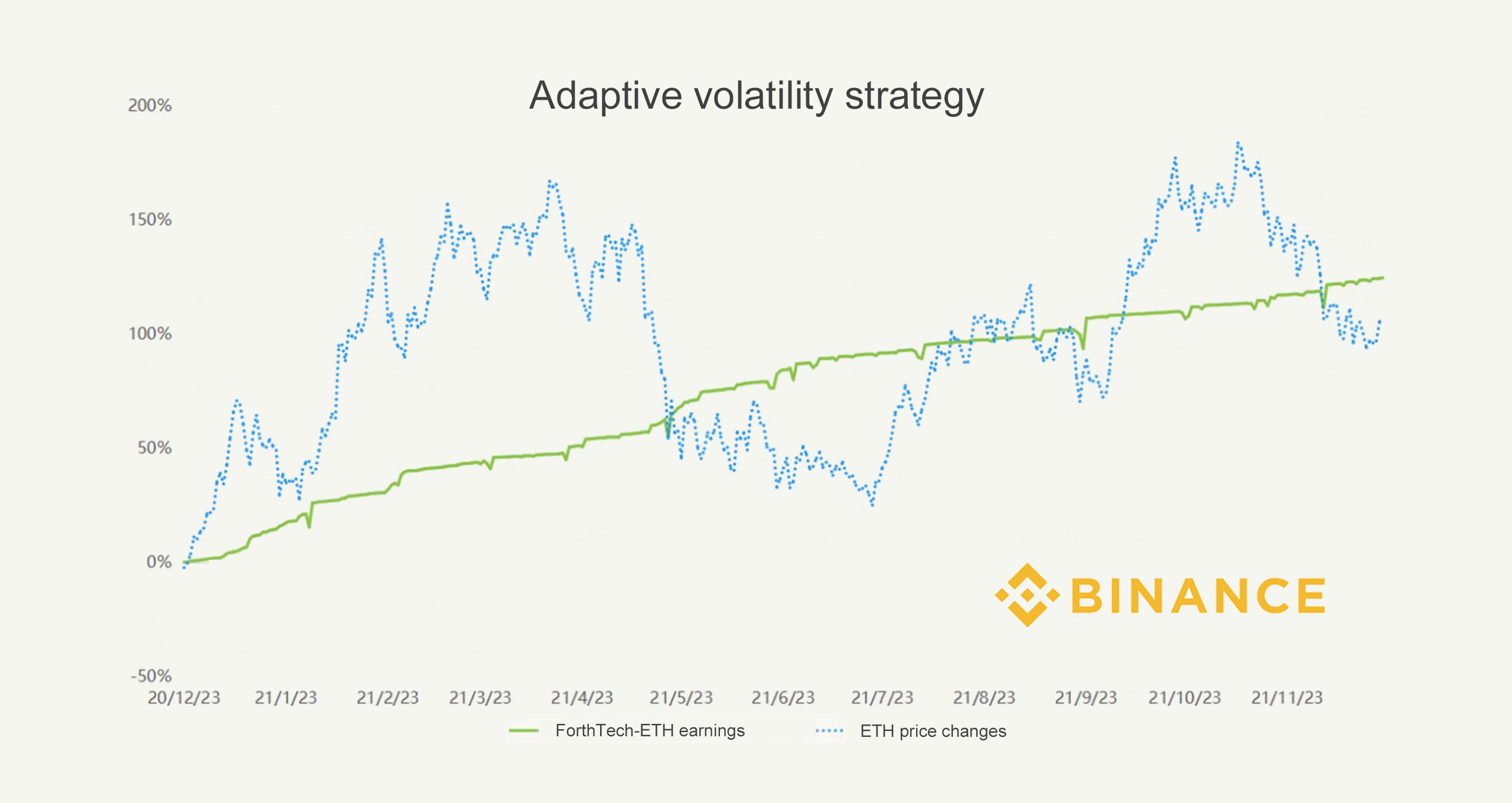

As shown in the figure, when the price drops continuously, positions are gradually opened to pull low-cost prices, and when the market rebounds, profits are made.

Expected quarterly earnings: 15%

Estimated maximum drawdown: 10%

Warning line: 95%

Closing line: 90%

Charging method: according to the actual income, the performance reward is drawn in a gradient; no subscription fee, custody fee, redemption fee is required, and early redemption pays the management fee and settles the performance reward according to the complete cycle

Trading platform: Binance, Bitmex, OKex, FTDX

Business scope: spot, perpetual contract, delivery contract

Real profit:

Cycle: 2020/12/23~2021/12/22 Cycle income: 124.59%

Annualized return: 124.94% Maximum drawdown: 9.51% Maximum holding ratio: 5.839%